Financial Risk Manager Part 1

Get started today

Ultimate access to all questions.

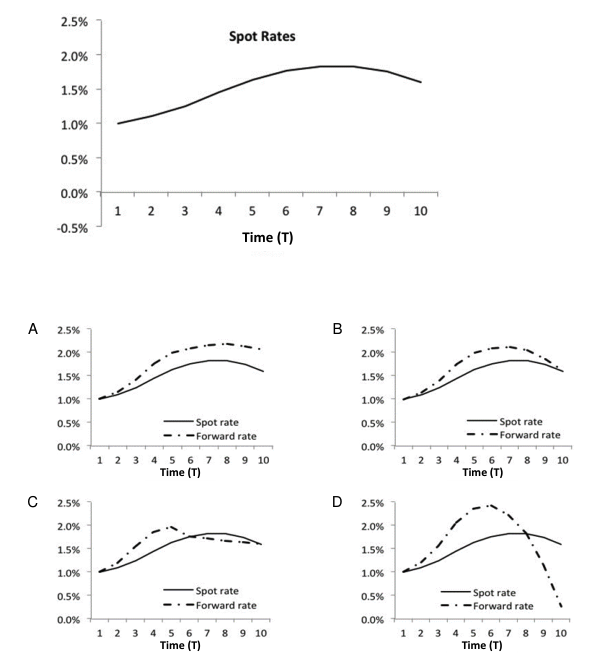

An analyst at a fixed-income investment fund is constructing the risk-free forward rate curve. Given the observed term structure of risk-free spot rates, which of the following charts correctly depicts the 1‑year forward rate curve beginning at time t?

An analyst at a fixed-income investment fund is constructing the risk-free forward rate curve. Given the observed term structure of risk-free spot rates, which of the following charts correctly depicts the 1‑year forward rate curve beginning at time t?

Exam-Like

Last updated: January 28, 2026 at 19:55

A

See the chart in the image

7.0%

B

See the chart in the image

23.4%

Comments

Loading comments...