Financial Risk Manager Part 1

Get started today

Ultimate access to all questions.

A financial analyst is tasked with forecasting the potential returns for stock XYZ in the upcoming month. To facilitate this, the analyst has reviewed the returns from the past 12 months and determined that the average monthly return of the stock is -0.75%, with a standard error of 2.70%.

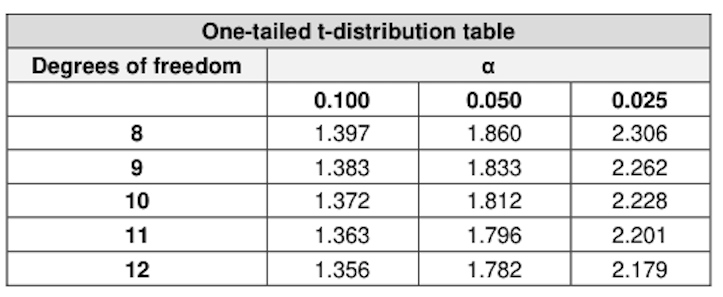

Refer to the one-tailed t-distribution table provided below:

Using the t-table, calculate the 95% confidence interval for the average return of stock XYZ.

A financial analyst is tasked with forecasting the potential returns for stock XYZ in the upcoming month. To facilitate this, the analyst has reviewed the returns from the past 12 months and determined that the average monthly return of the stock is -0.75%, with a standard error of 2.70%.

Refer to the one-tailed t-distribution table provided below:

Using the t-table, calculate the 95% confidence interval for the average return of stock XYZ.

Exam-Like

Last updated: February 7, 2026 at 03:16

A

-6.69% and 5.19%

42.4%

Comments

Loading comments...