Financial Risk Manager Part 2

Get started today

Ultimate access to all questions.

Comments

Loading comments...

Ultimate access to all questions.

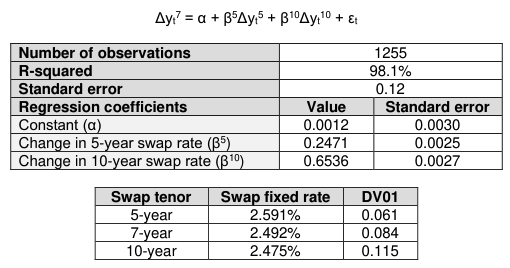

A derivatives trader at an investment bank is considering how to hedge a relatively illiquid 7-year USD interest-rate swap the bank just entered into as the fixed-rate payer. The trader recognizes that any profit resulting from the bid-ask spread may be lost if the trader is hedged with another illiquid 7-year swap and considers using the more liquid 5-year and 10-year USD interest-rate swaps as a hedge. To evaluate this possible hedge, the trader runs a two-variable regression model using changes in the 5-year and 10-year swap rates to explain changes in the 7-year swap rate. The regression model, regression results, and information about the swaps are given below:

What are the correct notional amounts of 5-year and 10-year swaps needed to hedge a USD 100 million notional amount of 7-year swaps?

A

USD 23.76 million of 5-year swaps, and USD 65.81 million of 10-year swaps

B

USD 24.71 million of 5-year swaps, and USD 65.36 million of 10-year swaps

C

USD 34.03 million of 5-year swaps, and USD 47.74 million of 10-year swaps

D

USD 68.85 million of 5-year swaps, and USD 36.52 million of 10-year swaps