Financial Risk Manager Part 1

Get started today

Ultimate access to all questions.

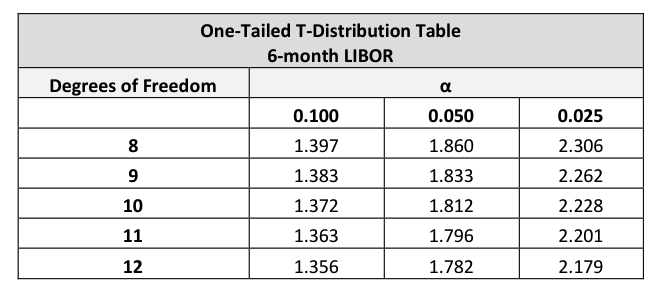

An analyst has analyzed the performance of stock XYZ over a 12-month period and found that the average monthly return is -0.75%, with a standard error of 2.70%. Using a one-tailed t-distribution, the analyst needs to determine the 95% confidence interval for the mean monthly return. Use the provided t-distribution table to calculate this interval.

An analyst has analyzed the performance of stock XYZ over a 12-month period and found that the average monthly return is -0.75%, with a standard error of 2.70%. Using a one-tailed t-distribution, the analyst needs to determine the 95% confidence interval for the mean monthly return. Use the provided t-distribution table to calculate this interval.

Exam-Like

Last updated: February 7, 2026 at 04:34

A

-6.69% and 5.19%

47.5%

Comments

Loading comments...