Financial Risk Manager Part 1

Get started today

Ultimate access to all questions.

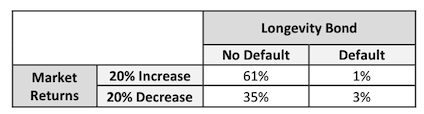

A portfolio manager is studying the relationship between the 1-year default probability of a longevity bond (issued by a life insurance company) and equity market returns. The manager has developed the following joint probability table based on preliminary research:

Based on the table, what is the conditional probability that the longevity bond defaults within one year, given that the equity market declines by 20% over that same period?

A portfolio manager is studying the relationship between the 1-year default probability of a longevity bond (issued by a life insurance company) and equity market returns. The manager has developed the following joint probability table based on preliminary research:

Based on the table, what is the conditional probability that the longevity bond defaults within one year, given that the equity market declines by 20% over that same period?

Exam-Like

Last updated: February 8, 2026 at 16:52

A

3.00%

14.6%

B

Comments

Loading comments...