Financial Risk Manager Part 1

Get started today

Ultimate access to all questions.

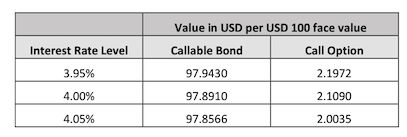

A risk manager is evaluating the price sensitivity of an investment‑grade callable bond using the firm’s valuation system. The table below presents information on the bond as well as on the embedded option. The current interest rate environment is flat at 4%.

The DVO1 of a comparable bond with no embedded options and with the same maturity and coupon rate as the callable bond is closest to:

A risk manager is evaluating the price sensitivity of an investment‑grade callable bond using the firm’s valuation system. The table below presents information on the bond as well as on the embedded option. The current interest rate environment is flat at 4%.

The DVO1 of a comparable bond with no embedded options and with the same maturity and coupon rate as the callable bond is closest to:

Exam-Like

Last updated: February 8, 2026 at 17:10

A

0.00864

14.5%

B

0.01399

Comments

Loading comments...