Financial Risk Manager Part 1

Get started today

Ultimate access to all questions.

Comments

Loading comments...

Ultimate access to all questions.

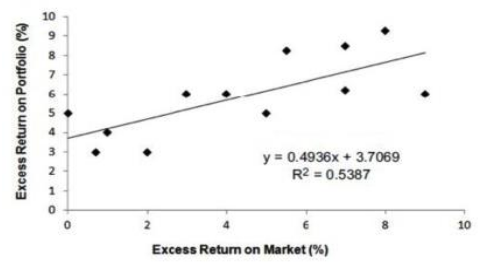

A risk manager is evaluating a portfolio of equities with an annual volatility of 12.1% per year that is benchmarked to the Straits Times Index. If the risk-free rate is 2.5% per year, based on the regression results given in the chart below, what is the Jensen's alpha of the portfolio?

A

0.4936%

B

0.5387%

C

1.2069%

D

3.7069%